Why investing when you're young is best thing you can do?

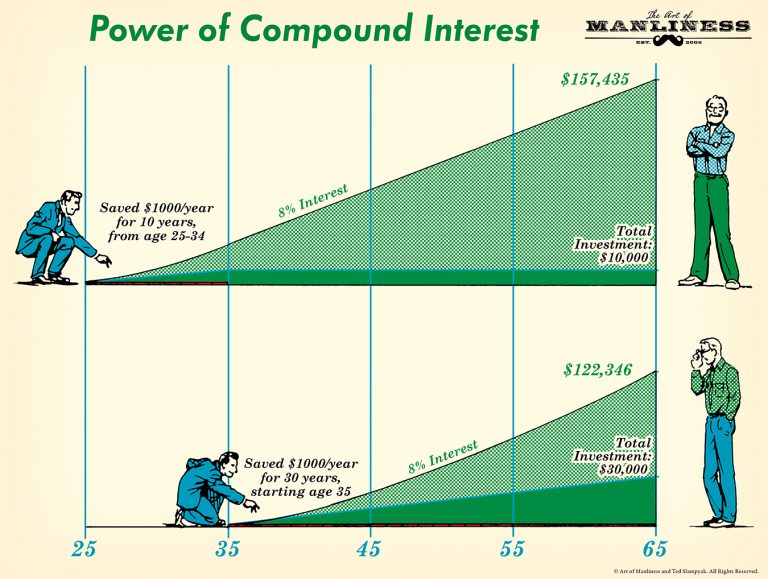

Whether you want to pay back debts, loans, prepare for a brighter future, secure your retirement, buy a house anything for which you need money in the long term, investing is one of the best things you can do especially if you're still young?

Why you would ask me? Well it's only because you will have plenty of time ahead of you allowing you to ride out the ups and downs in the market, and your money to grow.

Another reason why you should start investing, is that the social security won't be able to pay you a decent amount of money in the future, hence the need of reaping the fruits of investing to compensate your situation after retirement

You to save money before anything else?

Many people think that you will need to have thousands of dollars and even more to become an investor, that is not true, you can start by decent amounts of money, 500 dollars can do the job for you for example(we will discuss that later in the post)

You can do it by putting aside a percentage of your income in bank or in a vault...But before that you will need to manage your money clearly, try to allocate a percentage of your income to the different activities and expenses you have in life, and save 10 to 15% for you investment plan, if you can't afford that amount, it's not a problem just save you money and it'd be better to put in a bank where you can get interest

Once you have a decent amount to get started let's say 500$ you will be ready to enter the game

What can you invest in?

Stocks:

Stocks are pieces of ownership in companies, this means by buying them you own a part of the company in question, stock prices go up and down according to the law of supply and demand.

Companies issue stocks generally to pay off debts or in order to grow

Bonds:

These are loans you give to the government or to companies which agree to pay you back in a a number of years, meanwhile you keep getting interests

Bond are generally safer to invest in than stocks because you know in advance how much money you will be making, but little is the risk little is the gain.

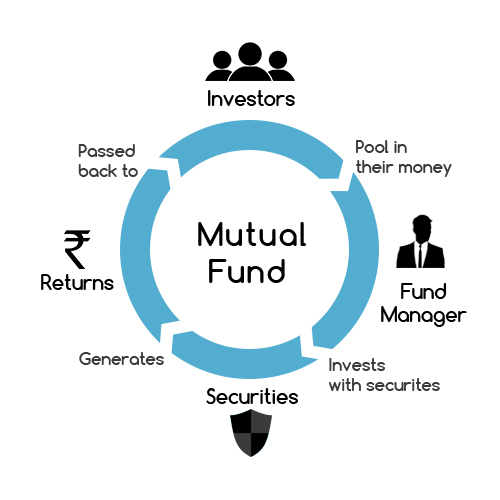

Mutual funds:

It's a company that manages your money for you, which means that its managers or invest in your place and you pay a commission for that, these type of companies invest in a mixture of assets which make them less risky than individual stocks

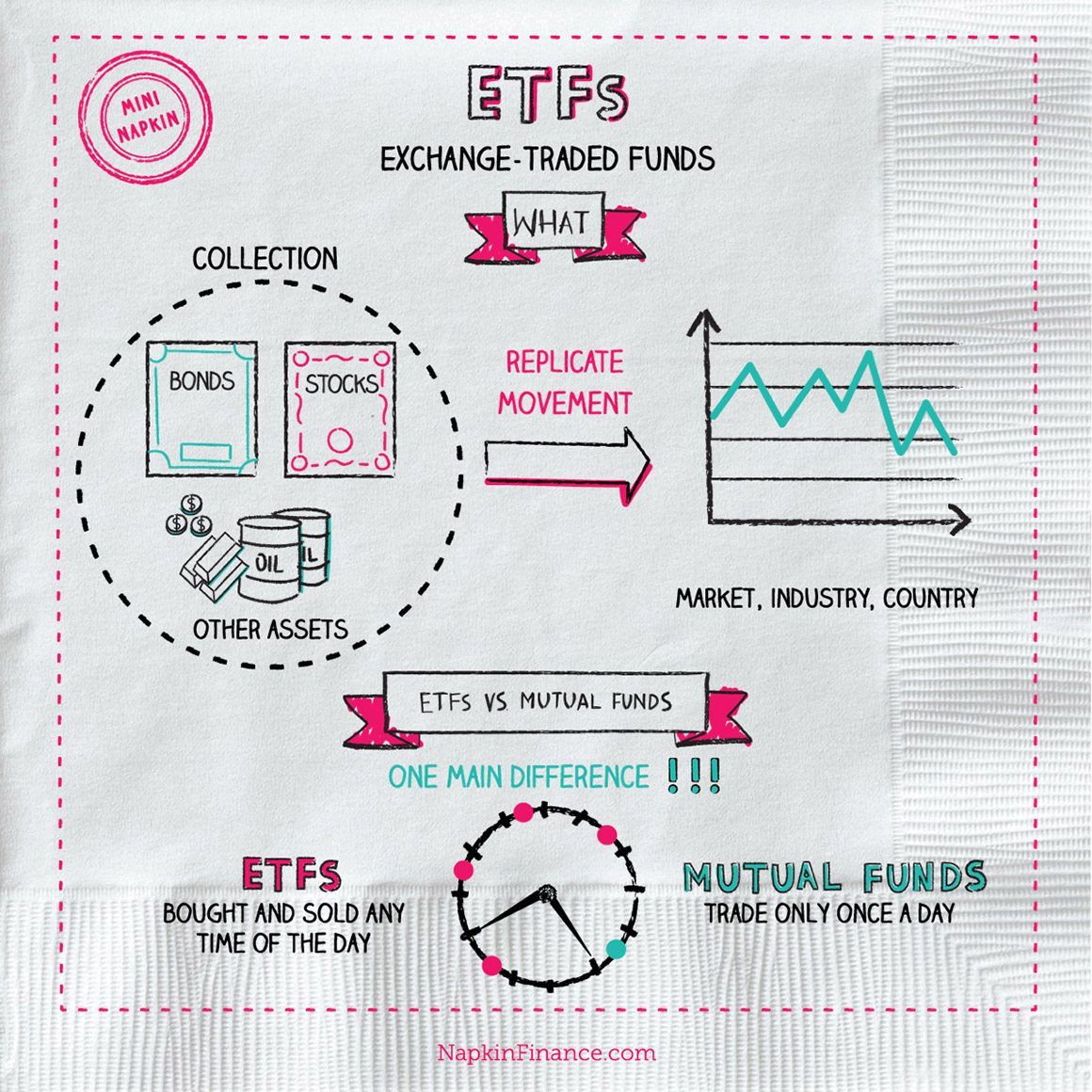

Exchange traded funds :

These are mixture of stocks, bonds, commodities or a combination of these that you can buy and sell through a broker, they have the diversification of assets like Mutual funds while being traded like stocks

There is other assets where you can invest but those 4 I mentioned are the most popular ones

How much should I invest?

Once you have saved money to start (let's say 100$ is the minimum) you can start by investing it and adding to it as you keep saving more and more money (a percentage of your income or earnings)

Where can I start investing?

Brokers:

In order to buy and sell stocks , bonds and ETFs(Exchange trading funds) you will need to use a broker which is a company that conducts transactions and may give investment advice, they are generally paid on a commission basis, here is a list of some popular brokers you can use:

Robinhood --- commission free broker (US residents only - 0$ min initial investment - 0$ commission per trade)

TD Ameritrade --- nice platform for beginners (International - 0$ min initial investment - 6.95$ commission per trade)

E*TRADE Financial --- best for mobile apps (US residents only - 500$ min initial investment - 6.95$ commission per trade)

Ally Invest --- best for commission free ETFs (US residents only - 0$ min initial investment - 4.95$ commission per trade)

InteractiveBrokers --- International (International - 10 000$ min initial investment - commision depends on the asset)

These are not the only one there is many others you can look for them in the web

Keep in mind that you will be completely free in choosing your assets although you may get advice from the brokerage company

Robinhood --- commission free broker (US residents only - 0$ min initial investment - 0$ commission per trade)

TD Ameritrade --- nice platform for beginners (International - 0$ min initial investment - 6.95$ commission per trade)

E*TRADE Financial --- best for mobile apps (US residents only - 500$ min initial investment - 6.95$ commission per trade)

Ally Invest --- best for commission free ETFs (US residents only - 0$ min initial investment - 4.95$ commission per trade)

InteractiveBrokers --- International (International - 10 000$ min initial investment - commision depends on the asset)

These are not the only one there is many others you can look for them in the web

Keep in mind that you will be completely free in choosing your assets although you may get advice from the brokerage company

Robo-advisors:

These are platforms you could invest in that have software and algorithms (created by humans) that work with little or no human supervision in order to find the best combination that suit your goals, they can then give you advice or automatically use your money for trading in exchange of a commission

because they're run with computers and require little human supervision the robo-advisors charge you a smaller fee compared to financial advisors, and are not subject to the pressure and emotions that can touch a financial advisors

here is a list of some popular robo-adivsors you can use:

Betterment --- best suited for new investors (US only - 0$ min initial investment - 0.25% annual fee)

Wealthfront --- best suited for investors who want a worry-free fully automated approach to their investment strategy (US only - 500$ min initial investment - commission-free for accounts with less than 10 000$ and 0.25% if you hit that amount)

Here is the link to a robo-advisor review you might find helpful

You should note that there is many types of mutual funds based on the nature of assets they trade and other criteria, here is the most common ones:

-Money market funds: invest in short term like government bonds, treasury bills, bankers’ acceptances, commercial paper and certificates of deposit...Ex: Vanguard Prime Money Market Fund

-Fixed income funds: invest in securities that offer fixed income like corporate bonds...Ex: Fidelity Fixed Income Investing

-Equity funds: invest in stocks. Ex: Capital World Growth And Income Fund | American Funds

-Balanced funds: invest in a mix of stocks and fixed income securities. Ex: HDFC Balanced Fund

-Index funds: invest based on an index like the S&P or Dow, so if the index goes up the fund owners gain and vice versa. Ex: Vanguard 500 index fund

-Specialty funds: the specialize on investing in a certain field like gold, real estate, oil commodities... Ex: Oppenheimer Gold & Special Minerals Fund

because they're run with computers and require little human supervision the robo-advisors charge you a smaller fee compared to financial advisors, and are not subject to the pressure and emotions that can touch a financial advisors

here is a list of some popular robo-adivsors you can use:

Betterment --- best suited for new investors (US only - 0$ min initial investment - 0.25% annual fee)

Wealthfront --- best suited for investors who want a worry-free fully automated approach to their investment strategy (US only - 500$ min initial investment - commission-free for accounts with less than 10 000$ and 0.25% if you hit that amount)

Here is the link to a robo-advisor review you might find helpful

Mutual funds:

These can be represented as a company which gathers money from investors to buy stocks, bonds and other securities in order to generate gains, they are controlled by professional money managers and a staff who allocate the fund assets to create wealth and income for the investors

When you as an investor buys a mutual fund you become a part owner of the company and you money is invested, and you can win or loose money based on the performance of the fund (if the fund investments increase in value all the fund owners gain money and vice versa)

-Money market funds: invest in short term like government bonds, treasury bills, bankers’ acceptances, commercial paper and certificates of deposit...Ex: Vanguard Prime Money Market Fund

-Fixed income funds: invest in securities that offer fixed income like corporate bonds...Ex: Fidelity Fixed Income Investing

-Equity funds: invest in stocks. Ex: Capital World Growth And Income Fund | American Funds

-Balanced funds: invest in a mix of stocks and fixed income securities. Ex: HDFC Balanced Fund

-Index funds: invest based on an index like the S&P or Dow, so if the index goes up the fund owners gain and vice versa. Ex: Vanguard 500 index fund

-Specialty funds: the specialize on investing in a certain field like gold, real estate, oil commodities... Ex: Oppenheimer Gold & Special Minerals Fund

How mindset is one of the most important factors when it comes at succeeding as an investor?

Before you place your money you need to have a clear plan containing where to sell, where to cut your losses if it's the case based on your research and experience, but most importantly you will have to stick to it and not get driven by emotions, because they won't be probably lead you to nowhere, try to avoid negative talks(there will always be some of them in the TV, newspapers, Internet) and concentrate on your plan and future movements.

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

0 Comments

Get your voice heard by leaving a comment